In-Depth Look at Arkansas’ Medical Debt Challenges

Medical debt is a critical issue that impacts many Americans, with Arkansas facing its own unique challenges. This comprehensive examination will explore the concept of medical debt, why it is problematic, and the specific situation in Arkansas. We’ll analyze contributing factors, the impact on citizens, and the policy responses in place to tackle this issue.

Medical debt encompasses the financial obligations arising from healthcare services. Common scenarios leading to debt include costly procedures, hospital stays, and insufficient health insurance. Individuals often struggle to manage their financial responsibilities, which negatively impacts their overall well-being.

Understanding medical debt is essential to address its implications on society. Medical debt arises when individuals cannot fully pay their medical bills, leaving them with outstanding balances. These can come from high costs associated with procedures, co-pays, and out-of-pocket expenses. Even insured individuals face this burden due to high deductibles and out-of-pocket maximums.

The process of medical billing and insurance claims is complex, leading to potential errors and disputes. Many individuals find it challenging to understand their bills, causing delays in payments and worsening financial strain. Long-lasting consequences of medical debt include deteriorated credit scores and instability. Often, individuals turn to borrowing, leading to additional interest and fees.

Medical debt is a significant problem for individuals and communities. It results in financial strain, increased stress, and reduced future healthcare access. Financial strain forces individuals to choose between medical bills and essential needs like housing and food. This can lead to instability and even homelessness.

Stress from medical debt affects both mental and physical health. Worrying about bills and debt collectors causes anxiety and depression. Medical debt also limits access to needed healthcare. Fear of incurring further debt leads individuals to avoid treatment, worsening health outcomes.

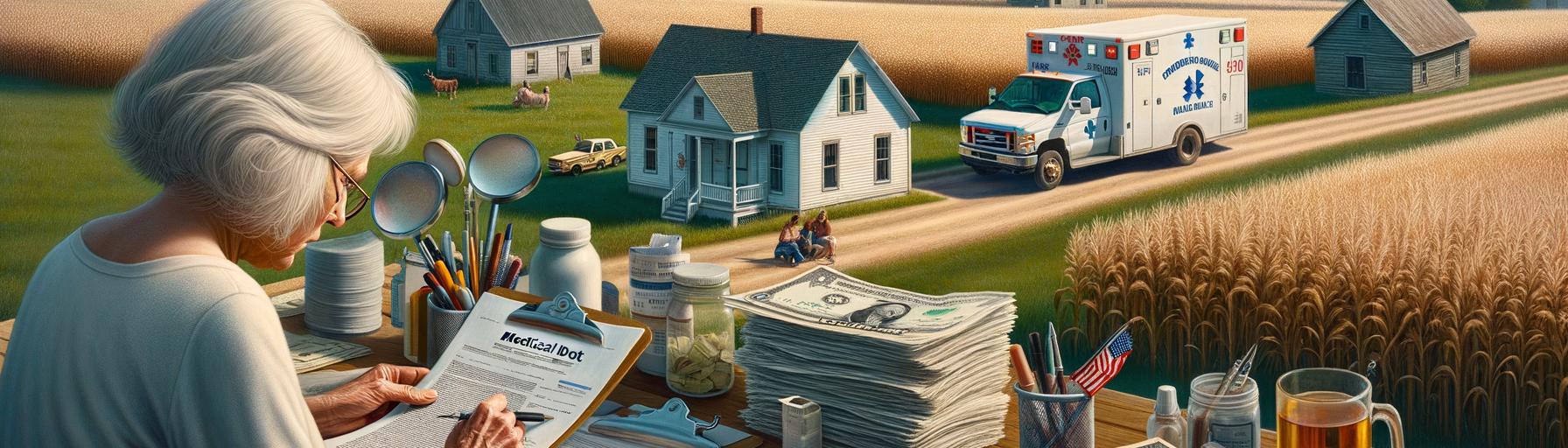

Arkansas faces similar challenges to the rest of the country with unique hurdles. The state aims to provide accessible and affordable healthcare, but faces issues like rural geography and high poverty rates. Approximately 10% of Arkansans remain uninsured, higher than the national average. Rural areas suffer from limited transportation and healthcare providers.

Medical debt significantly impacts many Arkansans, with a survey indicating 26% struggle with outstanding bills. Rising costs of medical procedures, medication, and insurance contribute to this issue. For impoverished individuals, medical debt can be devastating, creating a cycle of debt and financial hardship.

Limited comprehensive insurance coverage exacerbates medical debt. Although Medicaid expansion improved coverage for low-income individuals, gaps remain for many working-class residents. Even insured individuals face significant financial burdens due to high deductibles and copayments.

Arkansas’ economic landscape further contributes to medical debt prevalence. Low median household incomes and higher poverty rates make it tough to afford necessary medical care. Unemployment and underemployment limit access to employer-sponsored insurance, resulting in delayed medical care and higher costs when eventually sought.

Addressing medical debt factors in Arkansas requires a multi-faceted approach. Advocacy for affordable healthcare services, improved insurance coverage, and policies promoting economic growth are essential. By tackling these issues, Arkansas can reduce medical debt and ensure residents can access healthcare without financial strain.

The consequences of medical debt extend beyond finances, affecting various life aspects. Individuals with medical debt struggle to meet other financial obligations, like housing and education, resulting in declining credit scores and limited credit access.

Stress from medical debt worsens physical and mental health, increasing the risk of mental disorders and chronic conditions. The Arkansas government has implemented steps, including expanding Medicaid, implementing cost-containment, and advocating for transparent pricing policies. NGOs and charities also assist with financial counseling, negotiating bill reductions, and establishing aid programs.

The medical debt predicament in Arkansas requires comprehensive solutions. Addressing healthcare costs, improving insurance coverage, and preventing debt accumulation are crucial for a fair healthcare system. By working together, individuals, communities, and policymakers can alleviate medical debt and ensure quality care for Arkansans.

We understand the burden of medical debt and the stress it brings. Our dedicated team helps navigate the complex process of getting denied claims paid. Let us help relieve your financial strain and ensure rightful payment of your medical claims.